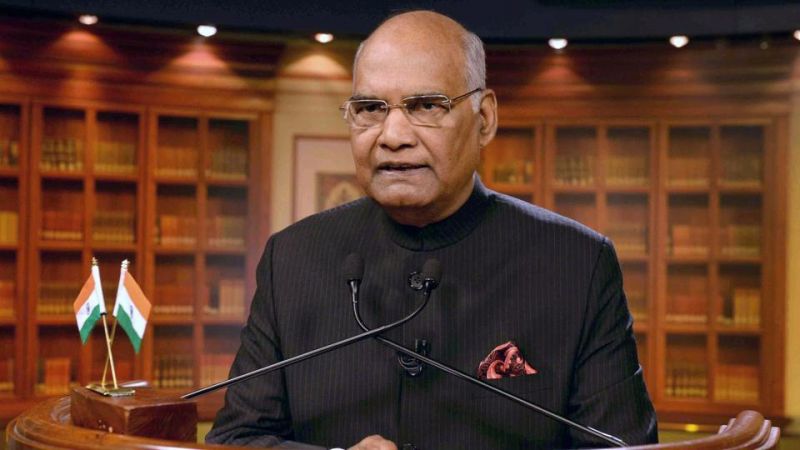

Today, Institute of Chartered Accountants of India (ICAI) is celebrating its 100th anniversary. To mark the day Indian President Ram Nath Kovind have addressed the gathering with the growth fact and significance of Charted Accountants in the economy. He stated that “ICAI is celebrating its platinum jubilee just as the Indian economy is set for a surge. In the next decade, probably even by 2025, India is expected to double the size of its GDP to five trillion US dollars.” Further, he added: “The growth in financial and business transactions will mean more work for chartered accountants and place a greater responsibility on you.”

Notably, on Sunday India is witnessing coalition of ICAI’s platinum jubilee and first anniversary of Goods and Service Tax(GST) implementation. For expressing the importance of GST which was implemented just one year before from now, the President said: “There has been a sustained effort over the past few years to formalize the economy, enforce rule of law, promote transparency in financial and business transactions, and make India much more of a tax compliant society. The introduction of GST has not been a standalone move,”

Additionally, he presented a short history of Modi government’s reform that were passed and facilitated economy in one or other way. He said: “The opening of bank accounts under the Pradhan Mantri Jan-Dhan Yojana for sections of our people who had hitherto not been able to access banking services; the very concept of the JAM trinity; the push given to digital payments and non-cash transactions as part of the demonetization process; the institution of the Insolvency and Bankruptcy Code; the passage of the Benami Transactions (Prohibition) Amendment Act - all of these are aimed at promoting transparent and smooth financial system,”

The dignitary further presented the gravity of GST in digitization of India: “enhanced reliance on technology and reduced scope for subjectivity”. “A massive Rs 45000 crore of GST refunds have been made till date - entirely online and through digital banking. About 350 crore invoices have been processed. That is roughly one crore invoices a day. Truly this has been a gigantic tax reform. In the 70 years from Independence to 2017, 66 lakh enterprises were registered with the authorities. In the one year of GST another 48 lakh enterprises have been added,” The President added.